Navigating the complexities of Medicare can feel overwhelming, especially when trying to understand the different parts and what they cover. Understanding Medicare Part B is crucial for accessing a wide range of healthcare services, from doctor’s visits to preventive care. This guide will provide you with a comprehensive overview of Medicare Part B, its coverage, costs, and how to enroll, helping you make informed decisions about your healthcare.

Understanding Medicare Part B: Medical Insurance

Medicare Part B is the part of Original Medicare that covers medical services and supplies needed to treat illnesses and conditions. It’s often referred to as “medical insurance” and helps pay for a wide range of services not covered by Part A (hospital insurance). Essentially, Part B fills in many of the gaps in Part A’s coverage.

What Does Part B Cover?

Part B covers a broad range of services, including:

- Doctor’s Services: This includes visits to your primary care physician, specialists, and other healthcare providers.

Example: Seeing a cardiologist for a heart condition or an endocrinologist for diabetes management.

- Outpatient Care: Services received outside of a hospital setting, such as at a clinic, doctor’s office, or surgery center.

Example: Physical therapy, occupational therapy, and speech therapy.

- Preventive Services: Screenings and vaccinations to help prevent illnesses or detect them early.

Example: Annual wellness visits, flu shots, mammograms, and colonoscopies.

- Mental Health Care: Outpatient mental health services, including therapy and counseling.

Example: Treatment for depression, anxiety, and substance abuse.

- Durable Medical Equipment (DME): Medically necessary equipment prescribed by a doctor.

Example: Wheelchairs, walkers, oxygen equipment, and hospital beds for home use.

- Ambulance Services: Transportation to a hospital or skilled nursing facility in a medical emergency.

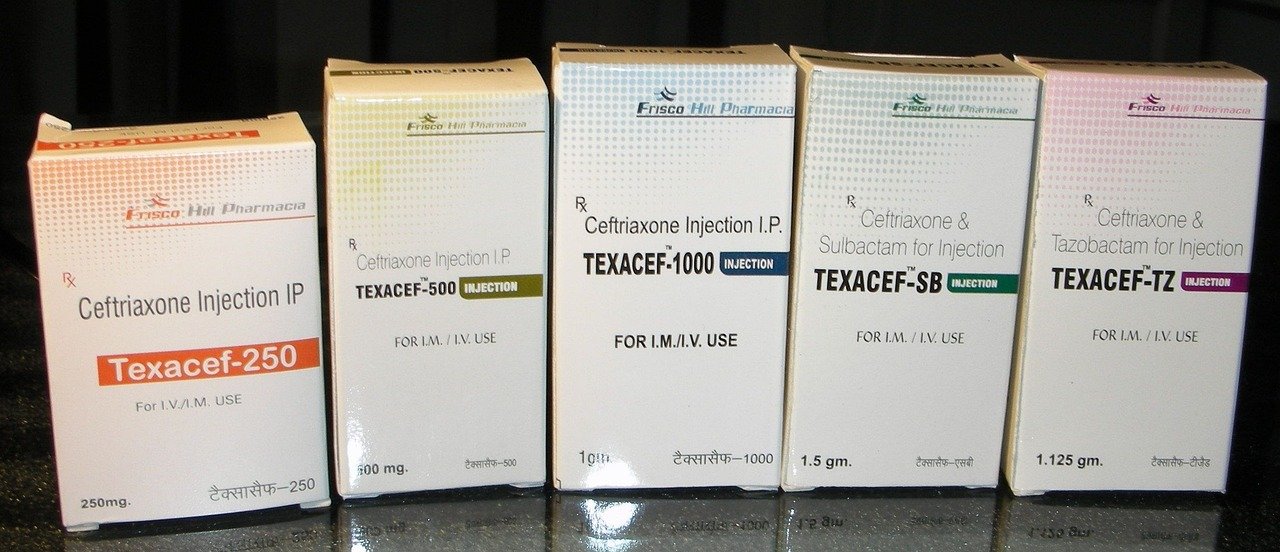

- Limited Prescription Drugs: Some medications administered by a doctor or other healthcare professional in an outpatient setting.

Example: Chemotherapy drugs, vaccines, and certain injectable medications.

What Part B Doesn’t Cover

While Part B offers extensive coverage, there are certain services it typically doesn’t cover:

- Most prescription drugs you take at home (covered by Medicare Part D).

- Routine dental care, such as cleanings and dentures.

- Routine vision care, such as eye exams and glasses.

- Hearing aids and related exams.

- Long-term care services, such as custodial care in a nursing home.

- Acupuncture (only covered for chronic low back pain).

- Cosmetic surgery.

Part B Costs: Premiums, Deductibles, and Coinsurance

Understanding the costs associated with Part B is crucial for budgeting your healthcare expenses. These costs include monthly premiums, an annual deductible, and coinsurance.

Monthly Premium

Most people pay a standard monthly premium for Part B. The standard premium can change each year, so it’s important to stay informed about the current rate. Higher-income individuals may pay a higher premium based on their income, known as Income-Related Monthly Adjustment Amount (IRMAA).

- Example: In 2024, the standard Part B premium is $174.70. However, those with higher incomes (over $103,000 for individuals) may pay a higher premium.

Annual Deductible

Before Medicare Part B starts paying its share of your covered services, you must meet an annual deductible. This is a fixed amount that you pay out-of-pocket each year.

- Example: In 2024, the annual Part B deductible is $240. Once you’ve met this deductible, Medicare starts paying its share of your costs.

Coinsurance

After you meet your deductible, you’ll typically pay a coinsurance amount for most Part B services. Coinsurance is a percentage of the cost of the service. For most services, the coinsurance is 20% of the Medicare-approved amount.

- Example: If you receive a service that costs $100, and Medicare approves $80 of that cost, you would pay 20% of $80, which is $16. Medicare would pay the remaining $64.

Cost-Saving Tips

- Consider a Medicare Advantage plan: These plans often have lower premiums and out-of-pocket costs than Original Medicare.

- Look into Extra Help: This program helps people with limited income and resources pay for Medicare prescription drug costs.

- Use preventive services: Many preventive services are covered at no cost to you, which can help prevent serious health problems.

Enrolling in Medicare Part B

Enrolling in Medicare Part B is a key step in ensuring you have comprehensive healthcare coverage. There are specific enrollment periods you should be aware of to avoid penalties or gaps in coverage.

Initial Enrollment Period

This is a 7-month period surrounding your 65th birthday. It starts 3 months before the month you turn 65, includes the month of your birthday, and ends 3 months after.

- Example: If your birthday is in July, your initial enrollment period runs from April 1 to October 31.

General Enrollment Period

If you don’t enroll during your initial enrollment period, you can enroll during the general enrollment period, which runs from January 1 to March 31 each year. However, your coverage won’t begin until July 1 of that year, and you may be subject to a late enrollment penalty.

Special Enrollment Period

You may be eligible for a special enrollment period if you delayed enrolling in Part B because you were covered under a group health plan based on current employment. You have 8 months after your employment or the group health plan coverage ends to enroll in Part B without penalty.

- Example: If you retire from your job in August, and your employer-sponsored health insurance ends, you have until April of the following year to enroll in Part B without incurring a penalty.

Avoiding Late Enrollment Penalties

If you don’t enroll in Part B when you’re first eligible and you’re not covered under a creditable health plan (such as employer-sponsored insurance), you may have to pay a late enrollment penalty. The penalty is a 10% increase in your monthly Part B premium for each full 12-month period that you could have had Part B but didn’t enroll. This penalty lasts for as long as you have Part B.

- Example: If you delayed enrolling in Part B for two years, your monthly premium would be 20% higher than the standard premium for as long as you have Part B.

Making the Most of Your Part B Coverage

Once you’re enrolled in Medicare Part B, it’s essential to understand how to maximize its benefits and access the care you need. Knowing how to find providers, understand your rights, and utilize preventive services can lead to better health outcomes.

Finding Medicare Providers

- Use the Medicare Provider Directory: Medicare provides an online tool to help you find doctors and other healthcare providers who accept Medicare. This tool allows you to search by specialty, location, and other criteria.

- Ask your doctor for referrals: Your primary care physician can refer you to specialists who accept Medicare.

- Check with your insurance company: If you have a Medicare Advantage plan, check with your plan to ensure the provider is in-network.

Understanding Your Rights

As a Medicare beneficiary, you have certain rights, including:

- The right to appeal coverage decisions: If you disagree with a coverage decision made by Medicare or your Medicare Advantage plan, you have the right to appeal.

- The right to access your medical records: You have the right to review and obtain copies of your medical records.

- The right to privacy: Your medical information is protected by law and cannot be shared without your consent.

Utilizing Preventive Services

Medicare Part B covers many preventive services at no cost to you. Taking advantage of these services can help you stay healthy and detect potential health problems early.

- Annual Wellness Visit: A yearly appointment with your doctor to create or update a personalized prevention plan.

- Screenings: Screenings for cancer, diabetes, heart disease, and other conditions.

- Vaccinations: Flu shots, pneumonia shots, and other vaccines.

Conclusion

Understanding Medicare Part B is essential for accessing comprehensive healthcare coverage and managing your healthcare costs effectively. From doctor’s visits and outpatient care to preventive services and durable medical equipment, Part B covers a wide range of services that can help you stay healthy and manage your health conditions. By understanding the coverage, costs, enrollment periods, and ways to maximize your benefits, you can confidently navigate Medicare and make informed decisions about your healthcare. Stay informed, utilize available resources, and don’t hesitate to seek assistance when needed to make the most of your Medicare Part B coverage.